Mar 27 | 2019

Drawing Parallels Between Breakbulk Logistics, Petrochemical Turnarounds

By AJ Kowaleuski, AP-Networks

There are striking parallels between breakbulk logistics and petrochemical process plant turnarounds. At the surface, the only commonality would be the fuel required to move the cargo. However, both are high-cost events requiring significant amounts of planning. Additionally, both possess a high risk of overage if the execution does not go as planned. As such, key learnings from turnarounds can be applied to breakbulk logistics.

Oil refineries and petrochemical plants have large-scale events, known as turnarounds, that occur once every three to five years, whereby the site shuts down to safely refurbish, renovate, or upgrade every piece of equipment within the unit. Just as with large-scale logistics, turnarounds are high-value, high-dollar events where minimizing overages and maximizing predictability are key concerns.

Turnarounds can cost hundreds of millions of dollars and planning can start up to three years in advance. Quite often, cost and schedule goals are missed, resulting in added costs. This is compounded by lost productivity opportunities resulting from extended down-time.

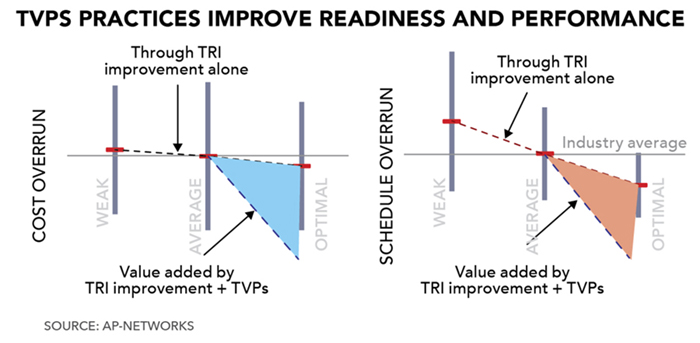

Based on years of industry experience and a quantifiable understanding of industry best practices, Asset Performance Networks, or AP-Networks, has developed Turnaround Value Practices, or TVPs, to maximize efficiency while minimizing costs for process plant turnarounds. AP-Networks research statistically correlates specific TVPs with competitive event performance.

While turnarounds may be seemingly localized to refineries, there are transcendent business concerns that are regularly addressed by best-in-class turnaround performers.

The best performers weigh contract strategy concerns by designing an event-specific strategy, contracting plan, payment plan, and associated timeline.

Top-quartile performers actively pursue schedule optimization through a detailed review of an integrated schedule, validating the use of codes and structures, network logic, schedule control and calendars.

The most competitive performers formally and thoroughly identify, evaluate, quantify and prioritize risks. Effective risk identification and management involves developing mitigation plans for high-impact and/or high-probability risks. Unsinkable ships have sunk with capable mariners at the helm by overlooking simple risks and failing to mitigate them.

Contract strategy, schedule optimization, and risk identification and management are just some of the best-in-class practices defined by AP-Networks as TVPs.

AP-Networks believes that the project cargo logistics industry, much like the refining and petrochemical industries, can also benefit from a targeted, TVP-based, up-front logistics planning process. Both industries need to ensure adequate resource availability for planning and execution. Both need realistic, predictable schedules. Both need well-thought-out contracting strategies. These, like many other challenges, are common and comparable business concerns. TVPs are proven solutions for addressing these challenges, and they hold promise for breakbulk logistics providers looking to achieve safe, competitive, predictable outcomes.

AJ Kowaleuski is a consultant for Asset Performance Networks – Houston.

Image credit: Shutterstock