Apr 27 | 2021

Hansen Sees Potential for Carbon Capture and Storage Projects

By Lein Mann Hansen

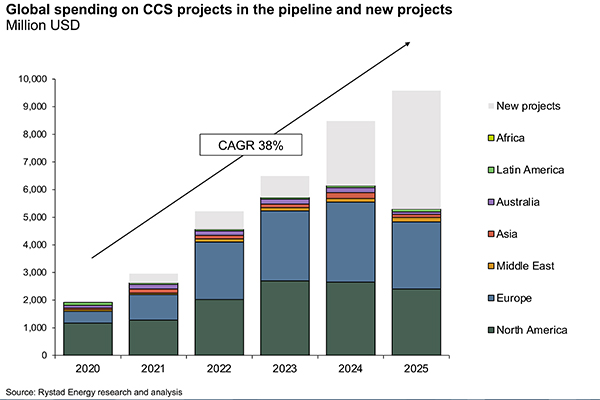

By Lein Mann HansenNational governments and leading industrial companies alike are pumping billions of dollars into the development and deployment of carbon capture and storage, or CCS, technologies. The interest in CCS has never been higher and the knowledge spillovers from different applications, technology improvements and network effects of shared infrastructure have contributed towards the declining costs of CCS, making this a viable option for many more players than before.

The network effects from shared infrastructure will be particularly interesting to track in Europe and North America – where some of the most exciting CCS projects are being developed, as these are expected to result in significant reductions in cost-per-tonne metrics.

The increasing preference for shared infrastructure as high-capacity pipelines, hubs or industrial clusters are reducing project costs and risks. The traditional format of having one source, one pipeline and one storage site has been turned on its head, as networks of several capture sites sharing transport and storage have emerged, allowing companies to focus on their core competencies and get economies of scale.

The increasing preference for shared infrastructure as high-capacity pipelines, hubs or industrial clusters are reducing project costs and risks. The traditional format of having one source, one pipeline and one storage site has been turned on its head, as networks of several capture sites sharing transport and storage have emerged, allowing companies to focus on their core competencies and get economies of scale.In Europe, most CCS projects are part of a hub or industrial cluster, such as Humber and Teesside in the UK, Northern Lights in Norway and Port of Rotterdam and Port of Amsterdam in the Netherlands.

The NOK 25 billion (US$2.9 billion) project Longship includes the capture of CO2 from cement production and a waste-to-energy plant with a combined capture capacity of 800,000 tonnes per annum, or tpa, of CO2, making it a highly expensive solution at present. Still, what is unique about this project is that it is not only the first large scale “open source” infrastructure project for receiving and storing CO2 from multiple sources that can provide significant cost reductions, but it is also a project that is set to incorporate transportation of CO2 by a ship which provides more flexibility.

In the transportation and storage stages, dubbed the Northern Lights, the liquid CO2 from these sites will be transported to an onshore terminal on the Norwegian west coast and from there, the liquefied CO2 will be transported by pipeline to a subsea storage location in the North Sea for permanent storage. The use of a ship provides flexibility to receive additional volumes of CO2 from third-party European customers against handling fees for receiving CO2 and storing it.

The project is planned to have available capacity of 700,000 tpa per year of CO2 when the first phase is completed mid-2024, with the possibility to expand capacity by an additional 3.5 million tonnes by way of incremental investments to increase capacity to 5 million tonnes. Utilizing the full capacity of the storage facilities could bring the net present cost per tonne down by 27 percent to about NOK 940 or US$110.

Another interesting example of shared infrastructure is the Alberta Carbon Trunk Line that commenced operation in 2020 and transports CO2 to storage in Central Alberta using a CAN$900 million pipeline, to be ultimately used for enhanced oil recovery. The 240-kilometer pipeline is designed to transport a total of 14.6 million tonnes of CO2 in the long term, making it the CO2 transport infrastructure with the highest capacity so far. Currently, Sturgeon oil refinery and the Nutrien Fertilizer plant CCS facilities supply 1.6 Mt of CO2 per year, leaving plentiful capacity to tie in many more CO2 emissions sources from additional industrial plants.

Lein Mann Hansen is a senior analyst at Rystad Energy.