Full Investment Coffers Present Challenges for Ports and Logistics

By Lori Musser

After a decades-long funding drought, U.S. federal infrastructure grant coffers are brimming with US$1.2 trillion. The Bipartisan Infrastructure Law has new and expanded grant programs coming on stream, and government credit programs are exploring ways to further assist. Still, transportation entities, including U.S. seaports, face challenges.

After a decades-long funding drought, U.S. federal infrastructure grant coffers are brimming with US$1.2 trillion. The Bipartisan Infrastructure Law has new and expanded grant programs coming on stream, and government credit programs are exploring ways to further assist. Still, transportation entities, including U.S. seaports, face challenges.

Analysts say funding still falls short of need, but it is enough to start addressing failing and undersized U.S. infrastructure, improve supply chains, and at the same time provide opportunities for project cargo and construction materials sectors.

The American Society of Civil Engineers’ 2021 Infrastructure Report Card provided a distressing but largely undisputed picture of U.S. need for better infrastructure. In the port sector, even after new federal initiatives and an estimated US$163 billion five-year capital investment program by ports and tenants, ASCE reports a funding gap of US$12 billion for waterside infrastructure. Moreover, there are unfunded projects outside port gates, with a US$32 million gap. For example, only 9 percent of intermodal-connector pavement is in good/very good condition according to ASCE. That jeopardizes port success, which is dependent on intermodal connectivity.

Chris Connor, CEO of the American Association of Port Authorities, or AAPA, said: “In the last generation there has been a complete lack of investment in port infrastructure and intermodal connectivity. It has not been a priority at the federal or state level.” That myopia meant U.S. port infrastructure and intermodal connectivity were not “resilient enough to cope with the recent 20 percent upshot in throughput.”

Chris Connor, CEO of the American Association of Port Authorities, or AAPA, said: “In the last generation there has been a complete lack of investment in port infrastructure and intermodal connectivity. It has not been a priority at the federal or state level.” That myopia meant U.S. port infrastructure and intermodal connectivity were not “resilient enough to cope with the recent 20 percent upshot in throughput.”

Many infrastructure issues are simply age-related. In a White House briefing Jan. 5, 2022, John Porcari, the Biden Administration’s Port Envoy, said some of the new infrastructure funds would upgrade infrastructure born in prior generations.

Gravy Train

Over a five-year period, the new U.S. Bipartisan Infrastructure Law provides:

• US$2.25 billion for the Port Infrastructure Development Program, or PIDP, grants.

• US$15.7 billion in INFRA and RAISE grants (Infrastructure for Rebuilding America, and Rebuilding American Infrastructure with Sustainability and Equity – transportation projects for all modes are eligible).

• US$5 billion in Consolidated Rail Infrastructure and Safety Improvements grants, or CRISI.

• The U.S. Army Corps of Engineers will receive US$2.7 billion in new funds (dredging and maintaining federal channels).

These amounts are supplemental to “normal” annual appropriations that, according to AAPA, were:

• PIDP, US$230 million.

• PIDP, US$230 million.

• Army Corps of Engineers, US$2.48 billion.

• RAISE and INFRA, US$2 billion.

• CRISI, US$375 million.

If Congress passes a federal budget, those “normal” appropriations should rise again.

Additionally, over five years there is US$25 million available to supplement annual appropriations of US$14.8 million for America’s Marine Highways (promoting sea-freight transportation); and US$400 million for a Port Truck Idling Program.

Even before the US$1.2 trillion proposal became law, it was clear certain industries would benefit. In an August 2021 Time.com analysis, the winning sectors were forecasted to include big telecom, global supply chain/e-commerce, metals and building materials, nuclear power, electric vehicles, and chemicals plants, among others.

A spending uptick should boost construction aggregates, cement, metals including domestic steel and copper, heavy equipment manufacturers and green energy, to name a few. A Kiplinger.com analysis in November 2021 favored such stocks, and commented: “The Biden administration’s preference for ‘buying American’ should give Nucor an advantage over its larger foreign competitors such as Luxembourg’s ArcelorMittal or Japan’s Nippon Steel,” and, “if you’re bullish on copper, then you’re bullish on infrastructure stocks such as Freeport-McMoRan ... Copper is a critical part of the green energy story, too.”

High Hopes, But Already Over-subscribed

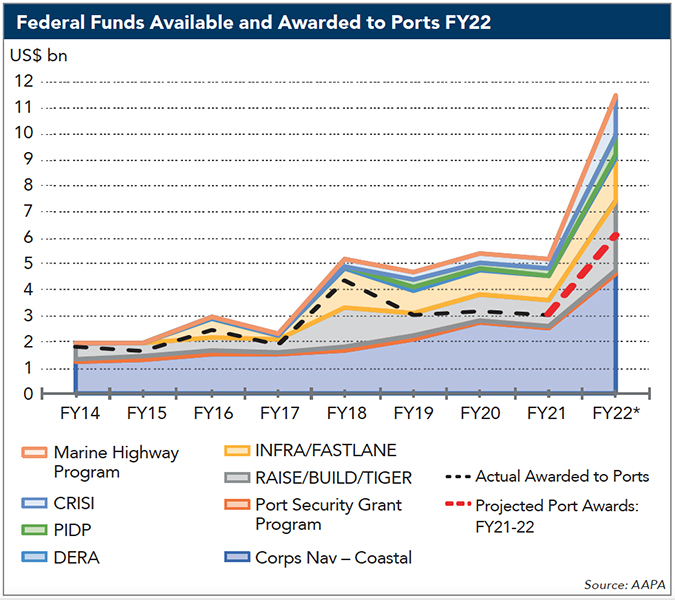

Seaport hopes are high, anticipating US$6 billion in grant awards in 2022, mostly from PIDP and Army Corps navigation funds, but ports will also compete with other modes for another US$30 billion or so, according to Ian Gansler, AAPA government relations executive.

About 10 percent to 15 percent of RAISE and INFRA funds have gone to ports over the last 10 years, Gansler said, adding, “We’d love to see this go up.” For the PIDP, he said: “It has been oversubscribed five-to-one. For every dollar given, there have been US$5 in applications.”

About 10 percent to 15 percent of RAISE and INFRA funds have gone to ports over the last 10 years, Gansler said, adding, “We’d love to see this go up.” For the PIDP, he said: “It has been oversubscribed five-to-one. For every dollar given, there have been US$5 in applications.”

Additional appropriations by Congress may prove especially important now that PIDP eligibility has been expanded to cover electric grid structures, which ports need desperately, and even electric infrastructure for passenger vessels, which is a departure from a historic focus on cargo.

Efficient port infrastructure is integral to the U.S.’s competitive edge at a time when ships are upsizing. The grant programs largely support capacity projects.

Port Tampa Bay, Florida’s busiest gateway by tonnage, was selected as an INFRA grant recipient in 2020 for a terminal expansion. Ram Kancharla, the port’s vice president of planning and development, said: “It is essential that port infrastructure keeps pace with cargo trends and growth to ensure bottlenecks are prevented.” The port has seen a 122 percent increase in steel and a 215 percent increase in general cargo this fiscal year, partly attributable to west central Florida’s tremendous population growth, which is driving new construction of all types. The record growth in breakbulk is accelerating the timeline for investment in warehouses and other port infrastructure.

Port Tampa Bay, Florida’s busiest gateway by tonnage, was selected as an INFRA grant recipient in 2020 for a terminal expansion. Ram Kancharla, the port’s vice president of planning and development, said: “It is essential that port infrastructure keeps pace with cargo trends and growth to ensure bottlenecks are prevented.” The port has seen a 122 percent increase in steel and a 215 percent increase in general cargo this fiscal year, partly attributable to west central Florida’s tremendous population growth, which is driving new construction of all types. The record growth in breakbulk is accelerating the timeline for investment in warehouses and other port infrastructure.

(See Related Story, "EXIM Eyes Domestic Projects.")

Grant programs also support port sustainability. John Wolfe, CEO at The Northwest Seaport Alliance, said the new infrastructure funding “will support our programs to fix aging terminal facilities, improve our capacity and efficiency, and make our trade gateway more competitive.” Also, it will allow the port to “expedite our goals of transitioning to zero emissions by 2050 through increased access to shore power for vessels and more efficient equipment and trucks.”

Grant programs also support port sustainability. John Wolfe, CEO at The Northwest Seaport Alliance, said the new infrastructure funding “will support our programs to fix aging terminal facilities, improve our capacity and efficiency, and make our trade gateway more competitive.” Also, it will allow the port to “expedite our goals of transitioning to zero emissions by 2050 through increased access to shore power for vessels and more efficient equipment and trucks.”

Trade Growth Will Continue

While the extraordinary spike in U.S. imports that wreaked havoc on the U.S. in 2020 and 2021 is slackening, trade growth is expected to continue. In a report published in December 2021, trade credit insurer Euler Hermes predicted global trade volume growth of 5.4 percent in 2022 and 4 percent in 2023, following an increase of 8.3 percent in 2021.

The U.S. Department of Transportation’s Bureau of Transportation Statistics and Federal Highway Administration, using their Freight Analysis Framework, has also projected continued freight growth, with cargo on all modes reaching 25 billion tons by 2045. That translates into 69 million tons per day moving on U.S. transportation infrastructure.

Connor noted: “This is the floor. If we are struggling with quality infrastructure at today’s level, and the problem is not going away, investment is required.”

New U.S. infrastructure funding has layered goals – keeping up with freight growth, and staying competitive in scale, efficiency, safety, reliability, sustainability and social benefits.

Port and transportation infrastructure is more than just an economic driver. Burt Moorhouse, president of Aransas Terminal Co., an emerging gateway for wind energy and offshore oil industry supply and service in Texas, said that U.S. ports are called on not only to facilitate trade, but to do so “American style,” which means adding layers of “good” things, like security, safety and environmental stewardship.

These are things U.S. citizens value. They have a cost. “As our nation attempts to recover from the Covid-19 shock, we see that our port infrastructure has very limited bandwidth for disruption,” Moorhouse said. Federal investment will facilitate a more robust supply chain and protect U.S. competitiveness and jobs.

Other federal funding programs support infrastructure. The Port Security Grant Program, for example, funds projects to help protect critical port infrastructure and supports port recovery and resiliency. The 2021 award level was US$100 million.

The Transportation Infrastructure Finance and Innovation Act (TIFIA) provides long-term credit assistance for qualified projects across modes. The Railroad Rehabilitation and Improvement Financing (RRIF) program offers long-term, low-interest loans.

Gansler said: “In California, the state government structured an agreement with DOT to prioritize the state’s port projects for TIFIA and RRIF loans. TIFIA isn’t always useful if projects don’t have long-term revenue.” He said it has been heartening to see the federal government going out of its way to fund port projects.

Barriers and Solutions

But money appropriated isn’t necessarily easy to get. Matching a project with eligibility, competing against large well-staffed authorities, and handling administrative hurdles once awarded requires acumen and resources.

Gansler said there is a need for more assistance for ports. Possible process improvements include a universal application for all port-related grants, a workaround for Buy American rules that delay projects and increase prices (perhaps redirecting funds to incentivize U.S. manufacturing of construction materials), less red tape, and the creation of statutory set-asides for ports. “INFRA’s new mandate to raise the amount given to multimodal projects to 30 percent is a step in the right direction. For imports or exports, seaports can be the bottleneck,” Gansler said.

“Now We Build!” – the AAPA’s latest catchphrase – reflects widespread appreciation for the level of federal commitment in the Bipartisan Infrastructure Law – more dollars for ports in this legislation than ever before. “We are grateful for these funds, but we are not content. This is not enough money to prepare ports for the cargo volumes forecasted,” Gansler said.

Based in the U.S., Lori Musser is a veteran shipping industry writer.

Illustration: Mark Clubb/Shutterstock

Photo 1: Chris Connor, CEO, American Association of Port Authorities, or AAPA

Chart: Source: AAPA

Photo 2: Ian Gansler, government relations executive, AAPA

Photo 3: Ram Kancharla, executive vice president of planning and development, Port of Tampa Bay

Photo 4: John Wolfe, CEO, The Northwest Seaport Alliance