Offshore Projects Ready for Lift-off in Region

By Thomas Timlen

By Thomas Timlen

Asia is expected to account for more than half of global offshore wind capacity by 2050 as nations look to transition away from fossil fuels. But where are the key markets? What challenges lie ahead for developers? And how can breakbulk position itself to support the buildout?

From Issue 2, 2024 of Breakbulk Magazine.

The offshore wind market in Asia is set for rapid growth in the coming years, with the region expected to account for more than half of global offshore wind capacity by 2050.

In its Emerging Asia powering ahead with decarbonization agenda report, international law firm Allen & Overy LLP found that Asia is at the forefront of the global challenge to balance economic development, climate adaptation and mitigation, and energy security, exploring multiple opportunities from coal to renewables, from batteries to hydrogen, and from offshore wind to nuclear to meet its growing energy needs and reduce its emissions.

The report pointed out that while “there have been significant increases in renewable energy capacity in recent years driven by commitments to Net Zero, there is still a long road ahead in emerging markets in Asia, where coal and natural gas still account for a significant proportion of the total energy mix. Recognizing this, ambitious goals for the increase of renewable energy have made their way into national power development plans for many countries and it is clear offshore wind has a key role to play in the energy transition agenda in emerging Asia.”

Speaking with Breakbulk, industry experts gave their views on the Allen & Overy report findings, examining the degree to which offshore wind will have a key role to play in the energy transition agenda in Asia, and also the potential for rapid growth.

“In our opinion a distinction needs to be made between emerging Asia and Asia more widely and of course also between nations that have meaningful seabed access and those that don’t,” said Matthew Taylor, managing director at Green Giraffe Advisory, a financial advisor for energy transition projects and investors that offers bespoke financial advice, market intelligence and development services in all renewable and energy transition technologies.

“In our opinion a distinction needs to be made between emerging Asia and Asia more widely and of course also between nations that have meaningful seabed access and those that don’t,” said Matthew Taylor, managing director at Green Giraffe Advisory, a financial advisor for energy transition projects and investors that offers bespoke financial advice, market intelligence and development services in all renewable and energy transition technologies.

“It is correct that offshore wind has a key role to play in developed Asia, being Australia and New Zealand, Japan, Korea and Taiwan but excluding Singapore and Hong Kong. With the exception of Australia and New Zealand, these nations are energy dependent and land constrained but are blessed with large areas of sea with reasonable wind conditions.

“While China is a market in and of itself that is charging ahead with the deployment of renewables including offshore wind - China contributed more than 50 percent of global new build capacity in 2023 - the prospects for offshore wind in other emerging markets are more mixed.”

Asia’s Market Impact

The International Renewable Energy Agency recently predicted that Asia is set to account for more than half of global offshore wind capacity by 2050.

However, Taylor is unconvinced: “Given the ambition in Europe and the U.S., that instinctively seems an unlikely prospect from our perspective. That is no to say, though, that it cannot be very impactful. With the emissions intensity of many Asian energy markets, given heavy dependence on coal in particular, the addition of clean power will have a greater positive impact on global carbon emissions than equivalent newbuild capacity in Europe or the U.S.”

Meanwhile, some Asian countries such as Vietnam already have a mix of onshore and offshore wind power facilities, while others have neither. “Specific countries [that are] expanding offshore wind and have the most potential include Taiwan, Japan and South Korea,” said Ruth Chen, a senior analyst at Westwood Global Energy Group, a global advisor to companies in the energy sector.

“Conducive to offshore wind development are government policies such as Taiwan’s Industrial Relevance Program, South Korea’s Renewable Energy Certificate (REC) competitive auction and Japan’s Green Innovation Fund for floating wind. These countries have the most potential as government-led policies and subsidies have initiated the development of offshore wind as well as local industry. Ambitious operational offshore wind capacity targets have been set in these three nations, which is acting as a further motivator for the respective governments to ensure that projects develop at a high pace.

“Conducive to offshore wind development are government policies such as Taiwan’s Industrial Relevance Program, South Korea’s Renewable Energy Certificate (REC) competitive auction and Japan’s Green Innovation Fund for floating wind. These countries have the most potential as government-led policies and subsidies have initiated the development of offshore wind as well as local industry. Ambitious operational offshore wind capacity targets have been set in these three nations, which is acting as a further motivator for the respective governments to ensure that projects develop at a high pace.

“According to our forecasts,” Chen continued, “Taiwan will see at least 6 gigawatts (GW) of capacity coming online before 2030 as it has an operational target of 21GW by 2035. A total of 2.8GW of lease capacity was awarded in 2023 via the Round 3.1 auction.

"Further capacity is due to be awarded in future leasing rounds, starting with round 3.2 which is scheduled to take place in 2024.”

Chen pointed out that Japan has also been increasing leasing activity to try and meet its target of 5.7GW by 2030. “In December 2023, 1.4GW of capacity was awarded in the Round 2 lease auction and the 1GW Round 3 tender has just been launched. South Korea is aiming to have 14.3GW online by 2030. Offshore wind developments in the country have been relatively slow due to the complex system that is in place, but things are now starting to pick up. The award of wind power fixed price contracts for five projects with a total capacity of 1.43GW in December 2023 highlights the progress that is starting to be made.”

Gauging Wind Potential

In Taylor’s view, there are many markets with potential for offshore wind in Asia.

“The tier 1 countries are the large OECD nations: Japan, Korea, Australia and New Zealand together with Taiwan and China, all of whom have strong wind resources combined with large power demand. The offshore wind market within each of these jurisdictions is at various degrees of maturity but all have strong fundamentals that appeal to a broad base of developers and investors. Taiwan is leading, but Korea, Australia and potentially Japan are now accelerating.

“Tier 2 markets are primarily Philippines, Vietnam and India with Bangladesh and Sri Lanka representing a third tier. These tier 2 markets have at least some of the core fundamentals needed but are currently lacking in some way, primarily with respect to regulations/policy.”

Allen & Overy identified several challenges that could hinder offshore wind development, including cost inflation, supply chain tightening, declining subsidies, vessel availability and jurisdiction-specific challenges.

Taylor said it is impossible to isolate just one challenge as being the most impactful in Asia. “Green Giraffe sees 2024 as being a year of transition for offshore wind with momentum hopefully coming back strongly, particularly towards the end of the year. The key reasons for this are easing of inflationary pressures and associated interest rates and of supply chain constraints, particularly on the turbines.

"Further, no market in Asia is without its own imposed headwinds, Taiwan being the most notable example with local supply constraints imposing further punitive costs on projects.”

Chen feels that cost inflation is a global issue which also has the most impact in Asia as well, alongside jurisdiction-specific challenges. “European turbine manufacturers have struggled with cost inflation in far advanced European and U.S. projects and have in turn hiked their prices to Asian customers,” she said. “This led to the trend of Asian customers, excluding China, considering the use of Chinese turbines as the price differentials are as much as 20-25 percent.

"Jurisdiction-specific challenges such as local content policies have become a sticking point for developers, but in countries such as Taiwan, there is a robust negotiation process between government and developers, resulting in a mostly mutually beneficial situation,” Chen added.

“The other jurisdiction-specific challenges include environmental concerns against offshore wind development from stakeholders such as fisheries who have been very vocal in countries such as South Korea, Japan and Taiwan. These have had an impact on the development of offshore wind projects from a very early stage.”

Learning Lessons

Allen & Overy’s report points out that a handful of smaller floating offshore wind projects around the world have provided valuable learning for the development of larger scale projects, starting in China “where the PFS-1 Southeast Wanning project will be among the, if not the, largest floating offshore wind project globally.

However, higher costs and technical and logistical challenges as compared to its fixed-bottom counterpart, as well as supply chain issues, likely mean that widespread installation of large floating offshore wind is still some way off,” Chen said.

Not everyone shares that view, however. “We do not agree that deployment of large floating assets in Asia is a long way off,” Taylor said. “In fact, we see quite some activity. Most notably we expect assets to mature in Korea and Taiwan, driven by upcoming auctions. It is correct that floating offshore wind is not price competitive with its fixed bottom cousin, so floating is dependent on higher levels of support for now. For this reason, and the relative maturity of fixed bottom, floating will remain a smaller portion of new build capacity for some years to come.”

While it remains to be seen where the most projects will be launched and how fast the pace will be, all indicators point to considerable growth in Asia’s offshore wind energy sector.

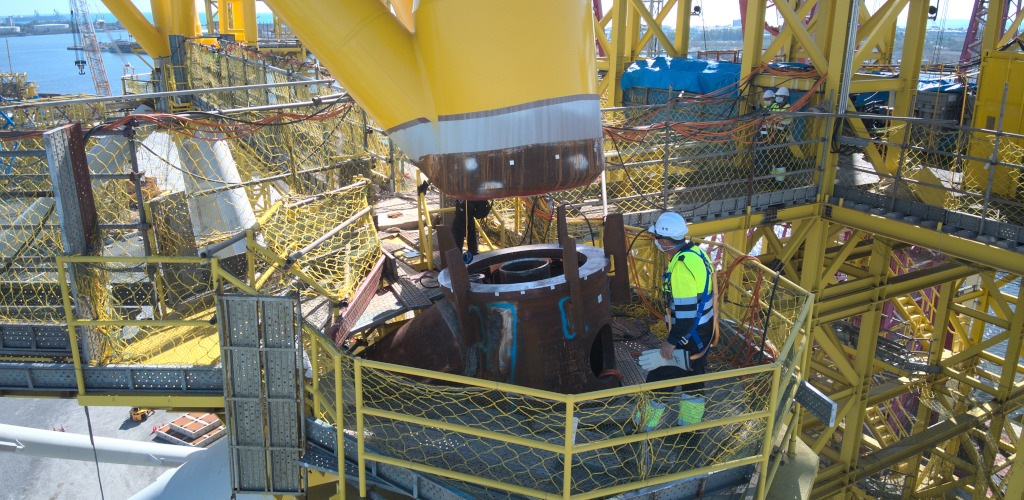

TOP PHOTO: Mammoet-Giant lifts a wind turbine jacket in Taiwan. CREDIT: Mammoet