Building Content for 2022 Breakbulk Middle East

Advisory Board Key Takeaways:

• Easing of freight rates, capacity constraints not expected until 2023, which means at least another year of flux

• Advisory Board: negative perception, or a complete lack of understanding, of the industry contribute to the growing talent gap

• Industry must realize and act upon sustainability and seafarers’ plight

Our Breakbulk Middle East Advisory Board, along with extensive research from our content team, explored key challenges, opportunities and trends facing the breakbulk and project cargo industries, to shape and build our content for the 2022 edition of Breakbulk Middle East.

At its 10 November meeting, our Advisory Board reviewed the findings from the research, which included interviews with more than 30 industry leaders across the Middle East’s breakbulk supply chain and logistics industry, which has face unprecedented challenges.

Industry Challenges

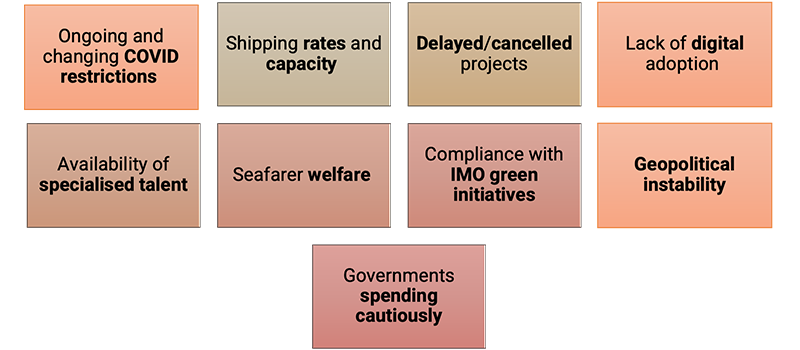

Sky-high freight rates and limited capacity were far and away the most notable challenges shared among research participants and our Advisory Board and suggested that we should not expect to see major easing until 2023, which means at least another year of flux.

In addition, ongoing and changing Covid restrictions resulting in delayed and cancelled projects, continue to challenge our industry and prevent real recovery. Governments spending more cautiously than before isn’t helping the situation, as many logistics service providers are counting on investment in capital projects to get them up and running again.

Talent Gap

Covid has also further widened the growing talent gap seen across our industry, which was already a cause for concern. In a highly specialized industry that requires trained and experienced talent, market-related furloughs, career changes, mergers and acquisitions and, consequently, redundancies have made this issue more critical than ever.

Our Advisory Board noted a negative perception of the industry, or a complete lack of understanding, contribute to the growing talent gap. Members reminded that it is the responsibility of those more experienced to help educate and inform the younger generation on the opportunities they can explore in the sector.

Breakbulk see this as its responsibility, to provide the platform for these conversations to happen. Therefore, we are proud that our Education Day will look at tackling this issue by engaging with the students and leaders themselves to inspire change.

Seafarer, Sustainability

Global Covid restrictions over the past few years has created another serious challenge, and that is our seafarer welfare. There have been horror stories across the globe of how our seafarers have been treated, from being stuck on ships for over a year, unable to enter ports due to restrictions, and many ships with crews just docked offshore waiting to hear about their next move.

Awareness of seafarers’ importance to our industry requires serious attention. As an industry we must band together and work to ensure seafarers’ working conditions and welfare are a top priority, as we continue to experience changing global restrictions as the world continues to reopen.

Finally, sustainability and compliance with global International Maritime Organization and other green initiatives continues to be a challenge across our industry. Topically, with the COP26 conference which closed in Glasgow last week, our Advisory Board recognized increased pressure from partners, as well as looking for ways to become more environmentally friendly across the chain.

Regional Meets Global

As the Advisory Board moved from challenges to industry trends, it was interesting to see both regionally specific as well as global trends coming out across the board.

Starting regionally, when looking at the Middle East, the major trends mentioned included the increasing targets of Middle Eastern countries to promote their national talent and encourage locals to take up important roles in both public and private companies. This has meant a shift in personnel in some of the major companies across the Middle East which will continue to be a trend looking ahead.

Saudi Arabia was mentioned on many occasions as being the country that will continue to provide the majority of project opportunities in the region. Following on from their Vision 2030 initiative and with their giga-projects in full swing, it will be exciting to see where the country is headed over the coming years, as all industry eyes strain for the country’s next project opportunity.

Another regional trend, which is also seen in other parts of the world is the increase in the number of decommissioning projects seen in the market. This trend is expected to further increase over the coming five years across the region.

Lastly, the UAE has released their Net Zero 2050 Strategic Initiative, which looks at their approach to sustainable development and how they plan to protect the environment. This initiative will likely mean changes in project focus in the region, as project professionals ready themselves for the global energy transition and zero carbon targets.

Industry Trends

Looking further afield at trends affecting our global industry, many of which link to the challenges mentioned earlier in this report.

We are seeing multipurpose vessel operators, or MPVs, carrying all kinds of cargo to cope with demand and traditional breakbulk cargo that had earlier switched to containers now shifting back to breakbulk. Traditional breakbulk carriers are, of course, delighted with this shift, however, it will be interesting to see how these changes when capacity starts to ease and we go back to more of a normal cycle, as experienced prior to the pandemic.

Across the board, project owners have appeared as more risk averse, with engineering, procurement and construction companies, or EPCs receiving smaller contracts than before, and owners spreading the risk across multiple partners.

Diversification of companies, as well as recent mergers and acquisitions, continue to be a trend, with all eyes on where the next one will happen.

Lastly, digitalisation was mentioned by nearly all research participants and Advisory Board members as being a trend moving forward and has been a topic at recent Breakbulk events. While action has been limited, Covid has provided a nudge for everyone to see the true potential that more digitalised process can offer internally and externally.

Our research and Advisory Board have highlighted some clear challenges, as well as exciting opportunities for the project cargo and breakbulk industry in the Middle East. At Breakbulk, we have used these insights to develop our conference agenda, which you can find out more about on our website.

We look forward to seeing you all in Dubai on 1-2 February at the Dubai World Trade Centre to continue the conversation on these important topics.

Breakbulk Middle East Advisors

Capt. Mohamad Al Ali

Senior Vice President, Ship Management

ADNOC Logistics & Services

Cyril Varghese

Cyril Varghese

Global Logistics Director

Fluor

Denis Bandura

Denis Bandura

Managing Director

BBC Chartering

Jack van den Brink

Jack van den Brink

Regional Managing Director – Middle East

Mammoet

Mohammad Jaber

Mohammad Jaber

COO Abu Dhabi; MD Air and Sea

DSV

Rafael Vicens

Rafael Vicens

Head of Global Projects & Industry Solutions MEA

DB Schenker Middle East

Tina Benjamin-Lea

Tina Benjamin-Lea

General Manager – Abu Dhabi

Kerry Project Logistics

Yasser AL Yassin

Yasser AL Yassin

Logistics Director

Petrofac