Jan 19 | 2024

Desalination Fast Becoming a Buzzword in South America

By John Bensalhia

By John BensalhiaWater scarcity has left Chile’s mining operations high and dry, but the construction of large-scale desalination plants in ever-increasing numbers is opening up the taps again!

From Issue 1, 2024 of Breakbulk Magazine.

In South America, demand for desalination plants is on the rise, in part because of the expansion of copper mines in Chile. The country has outlawed the use of fresh water for mining, so companies have turned to desalination to keep mines running. Indeed, Cochilco (the Chilean Copper Commission) claims that use of desalination is expected to grow by a massive 230 percent by 2030.

Jerry Ross, president of the Latin American Association for Desalination and Water Reuse (ALADYR), explained to Breakbulk that Chile has the highest installed desalination capacity in the region, with a rate of 9,500 liters per second. “This is due to a combination of factors, including a decade-long drought, rapid population and economic growth in arid cities like Antofagasta, and an increased demand for water by the copper industry. To meet this demand, Chile has built 23 large desalination plants, with plans for another six, to serve the needs of drinking, industrial, and agricultural purposes.”

An important benefit of desalination plants is the provision of a reliable source of clean drinking water. Ross gave the examples of Tocopilla in northern Chile and Puerto Deseado in southern Argentina: over 20,000 inhabitants that suffer from a significant shortage of water from conventional sources.

“However, they have implemented a robust and resilient supply system using desalination, which covers 100 percent of their drinking water needs. Unlike conventional sources of water, desalination is not subject to climatic variables such as rain or snowfall.”

An abrupt change in the climate has also seen the need for more desalination plants. “The weather has changed violently during the last years, with average temperatures increasingly rising,” noted Rodrigo Izquierdo, CEO of Chilean freight forwarder, Integral Chile.

“Most may say that that is the main reason of the current hydric shortage in the world. With the increase of mining and industrial development (especially in the north of Chile), along with the abrupt change in climate, there is a higher need of water, for industrial and domestic use. And don’t forget that in Chile, we have the driest desert in the world and actually, all the north is very dry.”

As a result, more and more desalination plants have been built, offering a quick water solution, as well as project business for the industry.

Growing Business

Desalination plants can be sited anywhere along the coast: “Chile has the advantage of having a very long coast, so there are a lot of possible spots to install desalination plants,” Izquierdo said. “As long as all environmental measures are taken to avoid damage or pollution to the ecosystems, a much-needed economic development may start with something as basic as water.”

Izquierdo added that in Chile there are currently around 30 desalination plants with most of them in the north, where mining is concentrated. “Never forget the huge industry that goes around mining, with all the suppliers such as equipment, clothing, laboratories, training centers, and vehicles and machinery,” he said.

ALADYR’s Ross noted that transportation and installation of large equipment to construct desalination plants, for example pumps and membranes, has become much more efficient over the years due to process refinements, even in difficult-to-access locations.

“Additionally, the market now offers more compact and relatively portable solutions for emergencies. One such example is the Água Doce program in Brazil. It consists of a group of desalination plants for brackish wells in rural communities located in the northeast region of the country.”

But there are challenges to overcome when servicing the burgeoning desalination industry, particularly when it comes to obtaining permits and adhering to regulations. “In some cases, construction can be delayed by up to four years due to the lack of timely response from the authorities involved,” Ross said.

Izquierdo noted that in Chile, logistics are easier than in other countries because of the territory. “We have a main highway that goes along most of the country and every important city connects to it. Also, there are some ports well suited to handle project cargo, some of them quite close to where the sites are, while others are farther away, but that’s where companies such as Integral Chile enter. Sometimes the only choice is the longer route, so a logistics company must know how to plan efficiently, do everything in the checklist and stick to the timetable or even beat it. To mount a desalination plant (or any other similar infrastructure) is no small feat. It’s a long-term activity that takes a lot of planning and rapport even before starting.”

Izquierdo noted that in Chile, logistics are easier than in other countries because of the territory. “We have a main highway that goes along most of the country and every important city connects to it. Also, there are some ports well suited to handle project cargo, some of them quite close to where the sites are, while others are farther away, but that’s where companies such as Integral Chile enter. Sometimes the only choice is the longer route, so a logistics company must know how to plan efficiently, do everything in the checklist and stick to the timetable or even beat it. To mount a desalination plant (or any other similar infrastructure) is no small feat. It’s a long-term activity that takes a lot of planning and rapport even before starting.”Roi Zaken Porat, in charge of water treatment process at IDE Technologies, agreed that the construction process is a lengthy one, adding that desalination plants are also expensive to build and also, in some cases, unsustainable.

However, desalination plant provider, IDE Technologies has come up with an economical solution that Porat said can reduce installation time by up to 70 percent while also providing substantial capex and opex savings. “We do this by using modular assembly instead of the old way of welding metal frames at the construction site, installing the equipment and welding the pipe at the site. We do all of it before we start installation.”

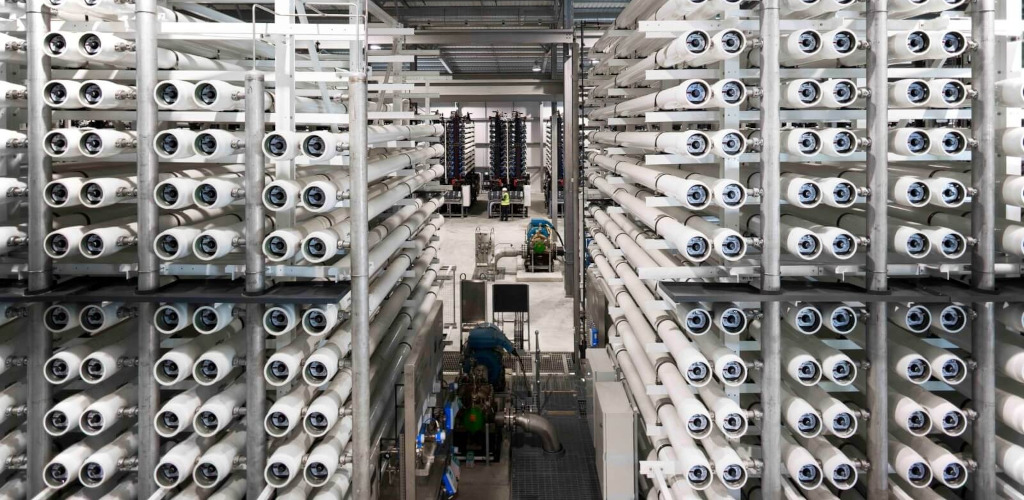

IDE’s large-scale reverse osmosis desalination plant is pre-fabricated in a workshop with all equipment and piping readily installed and tested on the skids before it reaches site.

IDE has recently been given the go-ahead to execute the EPC contract of the SADDN desalination plant, an initiative from Chilean state-owned copper mining company CODELCO to reduce water consumption levels by 60 percent by 2030. With CODELCO aiming to reduce its water consumption from conventional inland sources by 2030, the new initiative features a number of facets. These include desalination plant intake and outfall systems, a 160-kilometer pipeline and three pumping stations that are designed to lift desalinated water to around 3,000 meters above sea level.

Right Experience

To handle projects of the size and importance of desalination plants, Izquierdo said that it’s essential to have the experience of having managed different projects or at least special cargo. “You need to know the geography, how the ports work, to have the correct suppliers and partners, and of course planning capability and the resources to participate in the long run.”

But as Izquierdo added, the most important factor is the people and their know-how. “For example, it’s important to know how to execute operations, when to adjust and how to manage the unforeseen, to react quickly and efficiently. There is a lot of money involved on each project and there is little to no room to make mistakes.”

To avoid delays or undue storage of sensitive equipment such as reverse osmosis membranes, Ross said that close collaboration with the local authorities and detailed planning following project construction schedules are important considerations.

Looking to the future, Ross says that the technology for desalination is expected to advance further, making it more efficient and sustainable. “This progress may lead to a rise in the number of desalination plants being constructed in regions affected by water scarcity.

“As climate change and droughts continue to reduce the availability of natural water sources, and water demands from population and economic growth continue to increase, there will be a greater need for seawater desalination. Moreover, inhabitants of agricultural areas that have been affected by desertification, such as those in Baja California, are now demanding that their political representatives install plants to recover their activities.”

Ross added that multipurpose plants are also becoming more popular in the market, as they allow greater integration between companies and society.

“Hence, it will become more common to see a mining company in Chile constructing a plant for its operations and using the surplus for drinking water and agriculture in adjacent communities.”

Izquierdo added a note of cautious optimism. “With all the forthcoming development projects, especially in the north of Chile, such as mining (lithium/copper), energy or industrials, I’m very sure that there is a bright future, at least for a while.

“But it’s very important not to forget that there are a lot of environmental regulations that are growing in strength and that will put a lot of pressure on these kinds of projects. There are other ways to provide or generate water in a cleaner way, but they are not as cost-effective or as quick as a desalination plant – at least not now.”

He concluded that as long as desalination projects are responsible, fulfill all regulations, and take care of all necessary environmental issues, there will be a rise in the number of plants being constructed in Chile.

MAIN IMAGE: ACCIONA agreed a contract to build and operate a Chilean desalination plant for mining firm Doña Ines de Collahuasi. CREDIT: ACCIONA