Jul 13 | 2023

Projects Offer Only Long-Term Cargo Potential

By Jeremy Bowden

The following feature story is taken from Issue 4 of Breakbulk Magazine.

Several hurdles still need to be cleared before full scale commercial hyperloop projects can move forward. Eventually, breakbulk opportunities could be extensive, but opinions are divided over the likely speed and extent of commercial hyperloop development.

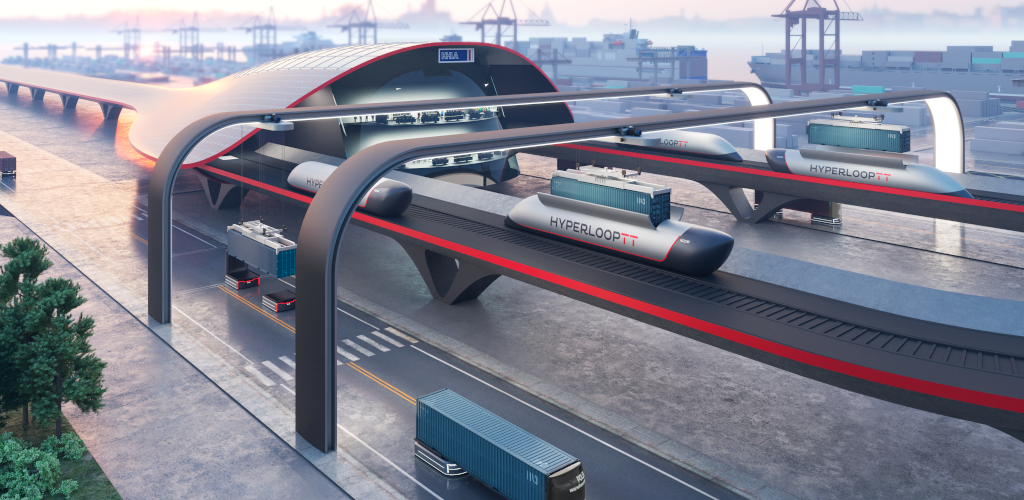

A hyperloop is high-speed transportation system for both public and goods transport with pressurized pods that run virtually free of air resistance or friction inside a tube using magnetic propulsion. Hyperloop technologies are slowly being finetuned through pilot projects and testing – mostly in Europe, but also in the U.S. and China, with both full-scale commercial passenger and cargo options being considered longer term. According to market growth reports, the global hyperloop technology market size was valued at US$1.15bn in 2022 and is expected to expand at a compound annual growth rate of 40.54 percent to 2028, when it will reach US$8.9bn. But opinions are mixed over the likely future of the technology, and any significant breakbulk opportunities are some way off, according to those who discussed the topic with Breakbulk.

Hyperloop start-up and research companies, Swisspod, Swissloop and Delft Hyperloop all agreed that before any full-scale commercial system is put in place, more testing is required. HyperloopTT also reported only test or prototype projects. This means test sites are the main area of construction right now and will probably be for several more years to come, presenting limited breakbulk opportunities in the short term. Once the testing is complete then regulatory issues need to be sorted and full political backing secured before a commercial project can be launched.

Developers are likely to be consortia backed by government in a similar way to railways. Hyperloop developers said that the first full scale project would probably be freight due to safety and passenger trust considerations, and it would possibly be in the UAE.

Expanding From Test Projects

The Delft Hyperloop team said that while there were no actual projects yet, “there are quite a few companies who are building large test tracks with actual vacuum tubes.” For example, Hardt Hyperloop is building a test track of around 300 meters in Groningen, which they hope to “eventually” extend to 2.6 kilometers by 2030. “This will prove the possibility of travelling with a hyperloop,” they said.

Work on the project has begun. Managed by the European Hyperloop Centre (a public-private initiative by the Province of Groningen, the City of Groningen and Hardt Hyperloop), the project is beginning hyperloop-specialized tube steel production in partnership with Tata Steel Nederland (TSN), Korean POSCO, and Hardt Hyperloop.

Steel has already been shipped and supply of the hyperloop-specific steel alloy will continue through to 2025, in addition to steel for the installation of magnetic tracks in 2023.

It is hoped that this early test section can then be expanded, and a regional network put in place by 2040 to transport freight and passengers. By 2050, a network of 24,000 kilometers is planned for Europe, although this vision is still some way off.

Other companies involved in testing include Swisspod, which opened Europe’s first operational test track in 2021 in Switzerland, and is partnering with TTCI, a subsidiary of the Association of American Railroads, for the development and construction of another Hyperloop testing facility in Pueblo, Colorado. Swissloop said EuroTube also wanted to build a 3-kilometer test tube in Switzerland by 2027.

HyperloopTT, meanwhile, has a test facility in Toulouse, and in May was awarded an US$800 million contract to construct a prototype hyperloop project in northern Italy, called Hyper Transfer, which is expected to begin later this year. HTT said more projects should be announced “in the coming months.” HTT has also been active in the development of a hyperloop insurance framework in partnership with Munich Re and safety and certification guidelines in the U.S. and Europe. HTT said it was still focused on its Great Lakes Hyperloop project in the U.S., which it claimed is the most comprehensive study for a commercial hyperloop system in the world so far.

Global Reach of Projects

In Asia, there are plans in China, which sees hyperloop development as a strategic priority, although a commercial project is not expected to be running until 2035. India also has plans for a network between major cities, starting with the Mumbai-Delhi corridor. A collaboration between Hardt Hyperloop and India’s TuTr Hyperloop aims to achieve interoperable hyperloop technology between Europe and India.

And in west Asia, Hyperloop One (previously Virgin) is reportedly considering a freight route (after abandoning plans for a passenger route last November) between Dubai and Abu Dhabi in partnership with DP World, known as DP World Cargospeed. In addition, Hyperloop Saudi Arabia eventually has plans to connect the country’s futuristic Red Sea sustainable city, Neom, with Jeddah, Makkah, Riyadh, Kuwait, Abu Dhabi, Dubai, and Muscat.

However, Vlad Iorgulescu, COO of Swisspod, cautioned that none of the commercial plans had reached development stage: “There are proposed routes, but none of them have received any funding or regulatory approval. These processes take a very long time… There are test sites, and those are being expanded – but they are purely for testing technology and not for commercial use. After the testing is complete, the project needs to be prepared on a commercial basis, alongside the lengthy process of permitting, budgeting and obtaining rights of way before logistics are considered.”

Louis Chambre, operations lead at Swissloop, added that the outlook for the hyperloop industry was unclear. “On one side, Hyperloop companies/projects are convinced that it will become reality in the next 20 years; others don’t believe it will come at all. I expect that the first (commercial) project will become a reality in the UAE, where there is financial support and where the desert allows for easy use of tubes.”

Chambre added that while hyperloop activity would make most sense in Europe or the U.S., high speeds mean curving lines around obstacles such as villages is not possible. So, it is now felt that hyperloops will need to be underground – making them more expensive in those countries. “Then also comes the long-term financial question – is the EU able to commit to investing large sums for the next 30 years?”

Progress in Europe ultimately depends on support from the EU, national governments and private industry. Some manufacturing and project management companies are already involved. For example, Siemens, Leybold, Lawrence Livermore Labs, and Hitachi Rail are involved with Hyperloop TT and are developing aspects of the technology.

Some hyperloop start-ups have also received support from state-owned companies. For example, Zeleros has partnered with Spanish railway RENFE and Nevomo has signed a cooperation agreement with French railway company SNCF.

Testing Still to Be Completed

Swisspod’s Iorgulescu said that, to date, very few hyperloop companies had even built testing facilities, which he said were indispensable for any company involved. He cautioned that while certain subsystems within hyperloop technology had reached a level of maturity suitable for market deployment, the overall technology readiness level, or TRL, of the entire hyperloop system remained relatively low.

“While it is technically possible to build a hyperloop system using existing technologies, it would still require thorough testing and validation to meet rigorous safety and performance criteria, a critical step that is yet to be undertaken.” And to guarantee the economic viability of hyperloop, he said further advances were necessary, particularly in propulsion. “These advances aim to enhance energy efficiency and reduce infrastructure costs.”

The Delft team agreed that there are still some technologies that need to be developed, including lane switching, heat control, optimum system choice and how the pod will move from a vacuum environment to the station at atmospheric pressure.

In addition, strategic partnerships, regulations, and standards must be sorted out, all of which build upon the TRL of each existing hyperloop company, according to Iorgulescu. Delft said different companies in EU countries are still using different hyperloop systems, including hanging or floating pods, and different motors, which all needed to be standardized. Germany and Holland agreed last fall to cooperate in this area.

Iorgulescu said it was likely that the first operational routes for hyperloop would “become available towards the end of this decade,” but “predicting where the first routes will be implemented poses a challenge, as these projects heavily rely on political perceptions and incentives.”

Regulation a Prerequisite

As well as more testing, hyperloop developers agreed that the formulation and implementation of a robust regulatory framework was a prerequisite for hyperloop deployment in Europe.

Iorgulescu said the European Hyperloop would have to cross several countries, and will need to run alongside existing transport and other infrastructure. “This means that it will most likely be state-owned, and a lot of regulations will have to be implemented. Security will most likely have to be similar to that in airports and all countries must cooperate.”

Delft said that because the EU hyperloop would be international and take years to build, European standardization was crucial. “There needs to be regulations about what the infrastructure should look like and what systems should be used.

Without this, every country would do its own thing.” This is less of an issue in the U.S., where private capital is likely to play a bigger role.

Iorgulescu noted that the EU had already taken some initial steps in regulating hyperloop. A standardization committee (CEN/ CENELEC) has been founded and an initial regulatory framework was included in the European Commission work program in 2023 for the first time.

Swisspod said that seven companies (Hardt, Zeleros, Swisspod, HTT, Nevomo, Transpod and H One) are currently involved in manufacturing hyperloop components and project management. “Each company aims to develop its own proprietary technology either internally or by leveraging existing solutions from known suppliers.”

Hyperloop companies need to collaborate closely to shape the regulatory and standardization framework, but that is not happening. “Currently everyone is holding their cards close to their chest, and all are trying to build the whole thing, but over time you will see differentiation among the companies focusing on different areas, such as open-air solutions, some services, some on propulsion,” Iorgulescu said.

Swisspod is prioritizing the development of the hyperloop vehicle, with the ultimate goal of becoming the main provider within the sector, although HTT said it had teamed up with Airtificial in Spain to make its first full scale passenger capsules. Swissloop’s Chambre said the Hardt Hyperloop start-up is the biggest player on the European market and is focusing on development of a lane changing feature for the hyperloop track. Several companies are involved in different guidance systems. The competing technologies must be objectively assessed, and a single option chosen to ensure a standardized approach in Europe.

Iorgulescu said there was currently no breakbulk involvement with component design. “If we look at purely construction, we can take our inspiration from the rail network – it will be a similar form of construction and component installation, with exception of tube added on top (possibly).” The hyperloop can be above ground with islands, or in a ditch in the ground or below ground.

Depending on the option chosen there will be different logistics requirements and construction methods – large concrete slabs and stanchions may be required. The tubing material choice will be steel or composite material, with the main objective to reduce the cost of the tube and its operation.

Organization, Pitching and Tendering

Swisspod said that the logistics pitching and tendering process, when it comes, would be managed by consortia. “The realistic approach to realizing hyperloop infrastructure is through Public-Private Partnerships, which employ a design-build-operate-maintain business model. Under this model, a consortium consisting of various companies will collectively contribute with their expertise in specific areas,” Iorgulescu said.

The type of consortia was expected to depend on the scale of the project – if national, then national-backed consortia, if supranational then that needs to be at EU level. “But I think that these are conversations that are well in the future at this point. For these consortia to be formed, you need to build them around something; feasibility studies are a nucleus you can begin to build around, but as long as you don’t have the technology ready, you are doing just studies.”

However, HTT said it already had agreements with some construction and operations companies, such as WeBuild and Leonardo in Italy and global infrastructure leaders like Capgemini and Altran. A spokesperson said: “Innovative port operator HHLA in Hamburg worked with us to develop our HyperPort System which is being looked at by several leading ports around the world.”

Jeremy Bowden is a freelance journalist, researcher and analyst, specializing in energy matters with a focus on the energy transition.