Industry Calculates Climate Change Resilience

By Iain MacIntyre

Stakeholders in the global breakbulk and project cargo supply chain are actively advancing a range of measures to improve the sustainability of their infrastructure and operations in light of increasing climate change consciousness and regulatory requirements.

Stakeholders in the global breakbulk and project cargo supply chain are actively advancing a range of measures to improve the sustainability of their infrastructure and operations in light of increasing climate change consciousness and regulatory requirements.

However, despite such initiatives driving innovation and creating new opportunities, there is also expectation that the necessary pursuit of greenhouse gas emissions reduction will likely raise bottom-line costs for shippers and end consumers.

Rachel Schwalbach, ESG (environmental, social and governance) vice president, CH Robinson, said her firm’s primary approach to cutting emissions is to first find efficiencies within supply chains – including reducing empty miles and leveraging optimization opportunities.

“Mitigating emissions is a top priority for CH Robinson and our customers, but in order to reduce carbon emissions, shippers had to know where they were starting,” Schwalbach said.

“Mitigating emissions is a top priority for CH Robinson and our customers, but in order to reduce carbon emissions, shippers had to know where they were starting,” Schwalbach said.

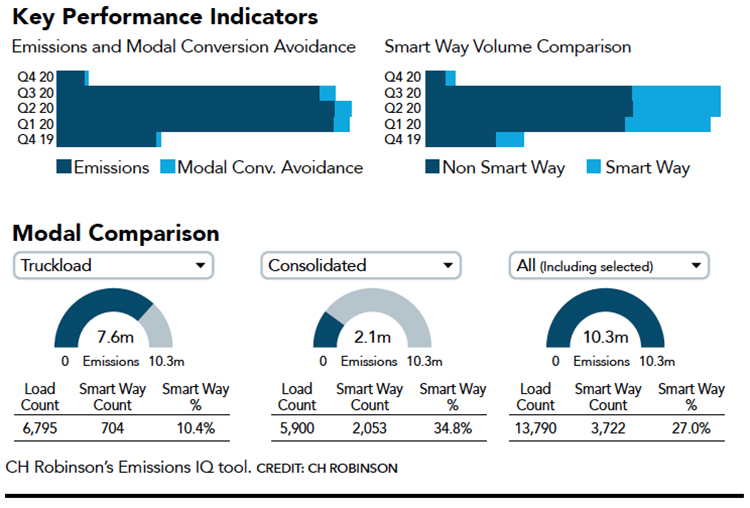

“That’s why we created Emissions IQ, a technology that measures carbon emissions across mode, date, location and retailer. After knowing your starting point, you can then begin to discover change opportunities.”

Emphasizing that tackling the challenges of climate change demands innovation, Schwalbach saw the self-service capabilities provided by the Robinson Labs-developed tool as a key technological advancement for CH Robinson’s clients. “Emissions IQ can benchmark a customer’s data against previous years and against their industry and identify areas of opportunity to take action and reduce emissions,” she said.

The tool is accredited to use the Global Logistics Emissions Counsel framework, giving shippers trusted and universally accepted data. “Most companies aren’t equipped to measure their carbon footprint across truck, rail, air and ocean transportation. Emissions IQ will eliminate that barrier, providing instant calculations and benchmarking data, while surfacing the best strategies to make meaningful carbon reductions right now,” Schwalbach said. “This information advantage, combined with CH Robinson’s expert global sustainability consultants, gives our customers the building tools to reach their sustainability goals.”

The tool is accredited to use the Global Logistics Emissions Counsel framework, giving shippers trusted and universally accepted data. “Most companies aren’t equipped to measure their carbon footprint across truck, rail, air and ocean transportation. Emissions IQ will eliminate that barrier, providing instant calculations and benchmarking data, while surfacing the best strategies to make meaningful carbon reductions right now,” Schwalbach said. “This information advantage, combined with CH Robinson’s expert global sustainability consultants, gives our customers the building tools to reach their sustainability goals.”

Schwalbach gave the example of Tempur Sealy, who CH Robinson helped to reduce domestic carbon emissions by nearly 1,000 tonnes of CO2e. “They’re on track to quadruple that this year too.” Additionally, CH Robinson helped an outdoor sports retailer reduce its carbon emissions by 1,270 tonnes in 2020 with further reductions happening in 2021.

Partnership Opportunities

James Woodrow, managing director at Swire Shipping – whose firm is a major multi-cargo carrier in the Asia-Oceania trade lane – said his line’s preeminent sustainability focus is supporting industry development of a “green” fuel source for shipping.

“Swire is taking an active role in the industry’s move to a green fuel source through our membership of the Getting to Zero Coalition and our recent decision to join the McKinney Moeller Maersk Centre for Zero Carbon Shipping,” Woodrow said, noting that both ammonia and methanol are potential fuel sources going forward.

“Swire is taking an active role in the industry’s move to a green fuel source through our membership of the Getting to Zero Coalition and our recent decision to join the McKinney Moeller Maersk Centre for Zero Carbon Shipping,” Woodrow said, noting that both ammonia and methanol are potential fuel sources going forward.

Woodrow added that, over the past five years, Swire Shipping and sister company Swire Bulk have invested “well over” US$1 billion in environmentally based fleet renewal. “These vessels are among the most fuel efficient in their respective classes. We continue to invest in technological and operational improvements that reduce our carbon footprint.”

The changeover to low-sulfur fuel for the carrier’s fleet, as necessitated by the 2021 enaction of IMO’s MARPOL Annex VI, “went smoothly,” he said, noting both that development – and other factors – will contribute to rising costs for shippers.

While he acknowledged that low-sulfur fuel is more expensive than high-sulfur fuel, the biggest increase has been in the general cost of fuel over recent months with oil prices bouncing back to more than US$80 per barrel as global demand recovers.

Woodrow added that governments introducing either carbon levies or emissions trading schemes will further increase the base cost of shipping. “Regulations will also decrease the speed of many older, less-fuel-efficient vessels as they comply with these new regulations.”

Leonard Sampson, CEO at the Port of Tauranga – the largest in New Zealand and claiming to offer a considerably greener global supply chain than its neighboring, major competitor, cites air and water quality as well as energy efficiency as major focuses.

Leonard Sampson, CEO at the Port of Tauranga – the largest in New Zealand and claiming to offer a considerably greener global supply chain than its neighboring, major competitor, cites air and water quality as well as energy efficiency as major focuses.

“Our vision is to protect and enhance our natural environment, investing in technology and embedding sustainable practices throughout our business,” Sampson said. “Our approach has been to break down each area of operations to find opportunities to create lasting change – for example, avoiding waste going to landfill.”

Carbon Footprint Interrogation

Given the reality that all businesses will need to interrogate the carbon footprint of their supply chains, Sampson saw his port as having positioned itself well for heightened sustainability requirements. “Port of Tauranga is the only New Zealand port able to accommodate bigger ships, which offer a lower-carbon supply chain for importers and exporters. By far the largest proportion of carbon emissions in New Zealand’s container supply chain relates to the “blue water” or ocean-going component of the cargo journey.

“Landside emissions from road or rail transport contribute only a small percentage of the total carbon emissions related to container imports and exports. Larger vessels have higher fuel efficiency and lower emissions and have a 20 percent to 30 percent smaller carbon footprint over a typical container journey.”

“Landside emissions from road or rail transport contribute only a small percentage of the total carbon emissions related to container imports and exports. Larger vessels have higher fuel efficiency and lower emissions and have a 20 percent to 30 percent smaller carbon footprint over a typical container journey.”

He also predicted a continuation of the trend towards increased rail use in the port sector as part of a sustainability-improving domestic supply chain.

“We have a preference for rail over road for transferring cargo to and from the port because of its efficiency and smaller carbon footprint. More than half of all cargo is delivered or picked up from the port via rail and there is opportunity to absorb further growth on rail – for example, with our new Ruakura Inland Port joint venture with Tainui Group Holdings.”

Sampson described the Port of Tauranga, which has adopted the International Integrated Reporting Framework ahead of New Zealand’s 2023 implementation of mandatory climate-related disclosures, as having had several recent sustainability “wins.” These include dust suppression through a five-fold increase in wharf sweeping since 2017, use of water misting technology and improved cargo handling procedures. The port is working with port users to minimize fine dust becoming airborne. Log yard roadways have been reconfigured to prevent wind tunneling effects and concrete barriers have been introduced to keep unnecessary traffic out of dusty areas.

A second win is the reduction of carbon emissions through a 75 percent reduction in waste going to landfill in the past two years as a result of increased reuse and recycling of wharf sweepings. This has resulted in a significant reduction in greenhouse gas emissions associated to landfill decomposition.

A third win is energy efficiency. The port purchased hybrid straddle carriers for increased fuel efficiency in container handling with the first commissioned in early 2020. These have proven to be “reliable, quiet, comfortable and more fuel efficient,” Sampson said. “They are popular with operators too – one has averaged 21.5 hours of use a day.

“Our modern fleet of ship-to-shore gantry cranes have sophisticated electric motors that regenerate up to 700 kilowatts of electricity when lowering a container. Excess electricity can be made available to adjacent cranes lifting containers or fed back into the terminal to power refrigerated container connections,” he added. “Our light vehicle fleet is progressively being converted to electric or hybrid models.” Looking to further emissions-reducing measures on the horizon, Sampson said the next “big opportunity” lies in automation.

Sustainability Top of the Challenges

CH Robinson’s Schwalbach said customers of the multimodal transport and third-party logistics firm advise that, alongside concerns over shipping capacity, sustainability is among the biggest current challenges.

_800x400l.jpg) “Global supply chains are incredibly complex and multifaceted and the past two years have made that clearer than ever. Making progress on supply chain sustainability challenges and increasing efficiencies is something we have been solving for our customers for decades – constantly looking to reduce waste, consolidate freight, eliminate empty miles.”

“Global supply chains are incredibly complex and multifaceted and the past two years have made that clearer than ever. Making progress on supply chain sustainability challenges and increasing efficiencies is something we have been solving for our customers for decades – constantly looking to reduce waste, consolidate freight, eliminate empty miles.”

Ultimately, she noted, efficient supply chains increase savings and help shippers deliver on their sustainability pledges to their customers, investors and other stakeholders.

The 2021 State of Supply Chain Sustainability Report, published by the MIT Center for Transportation & Logistics, found that supply chain sustainability interest had either increased or at least remained the same among stakeholders during the pandemic.

“Feeding the demand to solve climate change comes with supply chain challenges that CH Robinson has deep expertise in overcoming. In CH Robinson’s renewable energy transportation and logistics business, the company saw growth of 654 percent in just three years.

“Success in these projects means that the market will see 14 gigawatts of clean energy – enough solar energy to charge 1.73 million electric cars and enough wind energy to power a city the size of London for four months. We are proud to leverage our scale and global suite of services to help our customers protect and preserve our planet.”

Offsetting carbon emissions also remains among the suite of environmental sustainability solutions being pursued within the supply chain, according to both Woodrow and Schwalbach.

Offsetting carbon emissions also remains among the suite of environmental sustainability solutions being pursued within the supply chain, according to both Woodrow and Schwalbach.

“In addition to finding efficiencies, we offer our shipper customers and carriers the option of purchasing carbon offsets through our partnership with Carbonfund.org Foundation, a leading 501(c)(3) non-profit climate solutions provider,” Schwalbach said. “Working through Carbonfund.org means those wanting to offset their emissions can support high-impact projects such as energy efficiency, forestry and renewable energy to offset emissions.”

Furthermore, Port of Tauranga’s Sampson added that shippers and ports need to keep investing in resilient equipment, infrastructure and technologies. While current models may not show damaging impact on infrastructure from sea level rise, severe weather events could well lead to flooding and therefore affect breakbulk and project cargo transport access.

Iain MacIntyre is a New Zealand-based, award-winning journalist, with lengthy experience writing in the global shipping scene.

Photo 1: Most companies aren’t equipped to measure their carbon footprint across all modes. CREDIT: CH ROBINSON

Photo 2: Rachel Schwalbach, C.H. Robinson

Chart: Key performance indicators

Photo 3: Janes Woodrow, Swire Shipping

Photo 4: Leonard Sampson, Port of Tauranga

Photo 5: Swire Shipping and sister company Swire Bulk have invested “well over” US$1 billion in environmentally based fleet renewal. CREDIT: SWIRE SHIPPING

Photo 6: Port of Tauranga is targeting greater use of rail as part of its environmental sustainability plans. CREDIT: PORT OF TAURANGA