Mar 07 | 2022

Rate Growth Pace to Slow by End of Q1 2022, Drewry’s Oatway Says

By Carly Fields

While the constraints in both the container and the bulk sectors are expected to last well into 2022, there are still reasons to be cautious on the medium-term outlook for multipurpose vessels, or MPVs.

While the constraints in both the container and the bulk sectors are expected to last well into 2022, there are still reasons to be cautious on the medium-term outlook for multipurpose vessels, or MPVs.Drewry’s Senior Analyst, Multipurpose & Breakbulk Shipping, Susan Oatway told Breakbulk that the continued supply chain issues dog MPVs as much as any sector with ships unable to call at Covid-bound ports.

Consequently, Drewry expects MPV freight rates to continue to rise over 2022, but at a much slower rate as supply chain problems start to come under control and shippers reach a ceiling for freight on MPV tonnage. MPV freight rates are expected to plateau by the end of Q1 2022.

Consequently, Drewry expects MPV freight rates to continue to rise over 2022, but at a much slower rate as supply chain problems start to come under control and shippers reach a ceiling for freight on MPV tonnage. MPV freight rates are expected to plateau by the end of Q1 2022.“Although the problems that continue to plague global supply chains are acting as a positive effect on this sector, the next wave of containership newbuildings, expected to leave the yards over 2023, will undoubtedly have a detrimental effect on MPV share.”

Oatway said she believes that MPV operators have for the large part made the best use of this period of growth. “I do think that they have taken every opportunity possible. More newbuildings would have been good, with associated demolitions, but there are strong reasons why that did not happen – not least because it is a cautious sector with little outside investment.”

Cargo Flip-Flop

Much of the MPV growth is attributed to the return of breakbulk cargoes to general cargo ships, which either struggled to secure space or faced prohibitive freight rates – or both – in the container trades. While Oatway is reluctant to put an absolute figure on how much of that cargo will stay with MPVs once container freight rates recede, she noted that the defining factor will be “how aggressive the container lines are at bringing those cargoes back.” Pre-2020 they were very aggressive and rates were driven very low, she said. “There may be less of that going forward, but we would still expect to see a significant portion returning to containers as they have invested in project cargo and containerizing breakbulk.”

On the supply side, Oatway noted that over the last few years, the combined fleet of heavy-lift capable tonnage (with safe working load, or SWL, more than 100 tonnes) and non-heavy-lift capable tonnage has been gradually contracting, with demolition levels exceeding newbuilding deliveries. However, that changed over 2021 with a slight increase in overall tonnage. Drewry expects that to continue into the short term. But, Oatway warned, this is not a reason for celebration as the shift is not due to a change in ethos, but simply because demolition levels are so low.

Drewry’s calculation of the age profile of the fleet reveals that more than 55 percent of the total fleet is more than 15 years old, while 40 percent is more than 20 years. In detail, the fleet ranges from an average age of 24 years for geared MPVs to 12 years for what Drewry classifies as premium project carriers with a lift capacity of greater than 250 tonnes.

But newbuild activity remains subdued and the orderbook low. As at the beginning of December the orderbook stood at slightly more than 1.4 million deadweight-tonnes, equivalent to less than 5 percent of the operating fleet. For the last five years, most of the growth in the fleet has been from the project carrier sector, as this is where the potential for future demand lies.

Oatway noted that the MPV sector is “probably one of the most cautious” when it comes to long-term investment, not least because its niche is heavily influenced by the competing container and bulk sectors. There is also very limited speculative ordering, with owners preferring to build to replace or build with a particular commodity/project contract in mind.

Cash has been scarce over the past recession-hit 10 years with freight rates close to, or sometimes below, operating costs. Hence, ordering new ships has come second to pure survival. Also, with the current surge in orders for containerships and bulk carriers, yard slots for newbuilds are a rare commodity. Drewry notes that more than 3.6 million 20-foot equivalent units of container carrier tonnage and more than 38 million deadweight tonnes of bulk carrier tonnage were ordered in 2021. This is pitted against less than a half-million deadweight-tonnes of new MPV tonnage.

Oatway felt that there may be some advantage to having a slightly tighter supply position for the MPV fleet from 2023 onwards. “From 2023 onwards we will see an influx of new container carriers. At that point the competition for general cargo will begin again in earnest. If MPVs are not also competing with themselves, there will be an advantage for the modern (under 15 years) project carrier.”

Constant Growth

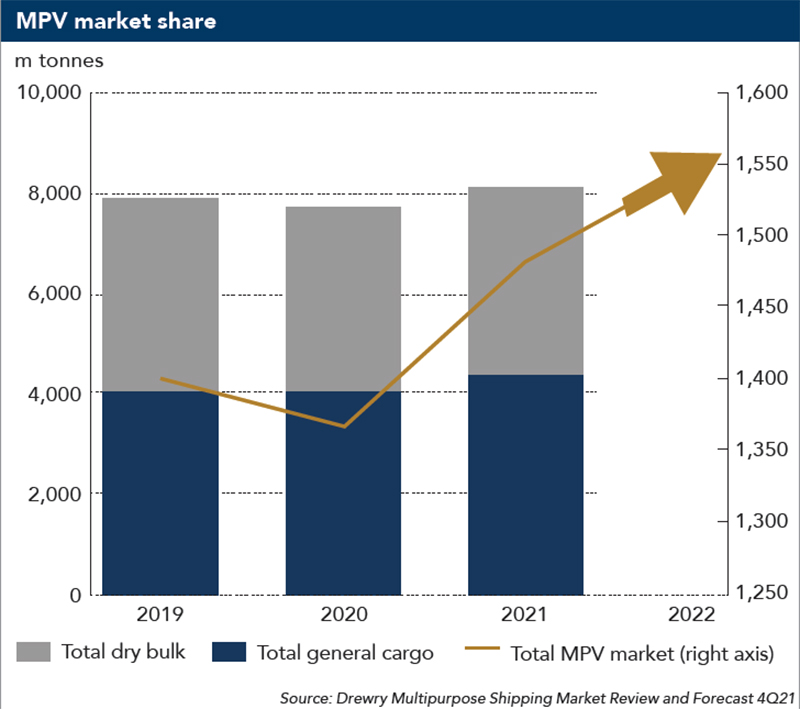

Turning to demand, Drewry includes general cargo in its dry bulk volumes measure. It said there has been “constant growth” in dry cargo volumes over the last few years, with the exception of 2020. Dry cargo volumes grew at an average annual rate of about 3 percent from 2012 to 2021.

Drewry’s dry cargo volumes also include bulk cargo and containerized cargo. The latter grew at an average annual rate of 3.7 percent from 2012-2021, compared to bulk cargo growth of 2.8 percent.

Drewry’s expectation is that the almost 6 percent growth seen over 2021 will slow over 2022 to a more reasonable 4.5 percent.

To determine the MPV share of total dry cargo Drewry reviews the total bulk and general cargo to make an assessment for market share for this fleet. It notes that much of the recovery at the beginning of 2021 was “goods-led” as consumer spending had not switched back to services from physical goods. But the sector has also seen the return of breakbulk commodities to MPVs, away from containers. It is this, Oatway said, that has boosted the growth in MPV share by some 8 percent compared with 2020. “Going forward, again we expect that growth to slow, but we expect market share to rise a further 5 percent over 2022 as the continued problems in the supply chain keep breakbulk cargoes on multipurpose ships.”

Carly Fields has reported on the shipping industry for the past 22 years, covering bunkers and broking and much in between.