US-EU Tariff Resolutions Promise Trade Boost

By Michael King

Sweeping Covid-19 lockdowns in Europe and Asia are casting shadows over steel demand and output forecasts, but market growth is still expected to be robust next year and beyond.

Sweeping Covid-19 lockdowns in Europe and Asia are casting shadows over steel demand and output forecasts, but market growth is still expected to be robust next year and beyond.

With container freight options increasingly unattractive for those moving steel due to the lack of capacity and soaring costs, the international steel trade is expected to be a lucrative base cargo for stakeholders in the breakbulk supply chain at least through 2022.

The steel trade outlook was given a significant fillip at the end of October when the G20 met in Rome. There, the U.S. and European Union agreed to ease tariffs on billions of dollars of steel and aluminum products, a move expected to boost trans-Atlantic breakbulk demand.

The deal, which ended the universal application of Section 232 duties by the U.S. on EU exports of the metals, saw the EU suspend related tariffs on U.S. products. It also brought an end to a mutually damaging trade dispute between the two economic superpowers over the metals trade which dated back to the Trump administration’s imposition of tariffs on national security grounds. This had resulted in EU exports of steel to the U.S. plummeting, as well as prompting a series of tit-for-tat escalatory measures from both sides.

Under the new deal, which mirrors those the U.S. has also struck with Mexico and Canada, steel and aluminum exports from the EU to the U.S. will be based on a tariff rate quota. This limits duty free exports of steel products from the EU to the U.S. to 3.3 million tonnes per annum. Under the terms of the deal, steel products must be entirely made in the EU, a provision included to prevent European steelmakers from selling finished products made from semi-finished products first imported from cheaper suppliers such as China and other non-EU suppliers.

Under the new deal, which mirrors those the U.S. has also struck with Mexico and Canada, steel and aluminum exports from the EU to the U.S. will be based on a tariff rate quota. This limits duty free exports of steel products from the EU to the U.S. to 3.3 million tonnes per annum. Under the terms of the deal, steel products must be entirely made in the EU, a provision included to prevent European steelmakers from selling finished products made from semi-finished products first imported from cheaper suppliers such as China and other non-EU suppliers.

Coalition vs Dirty Steel

Both the U.S. and EU also agreed to work on a global deal that seeks to promote “green” steel and aluminum. This carbon-based arrangement is designed to address both Chinese overproduction and carbon intensity in the steel and aluminum sectors, especially the use of heavy carbon-emitting coal in steel production.

“The aim is to restrict ‘dirty’ steel, and this will help boost steel trade between the U.S. and EU if supply from countries such as China and India is being restricted when this is rolled out in two years’ time,” said Felix Schoeller, general manager of AAL Shipping.

“The aim is to restrict ‘dirty’ steel, and this will help boost steel trade between the U.S. and EU if supply from countries such as China and India is being restricted when this is rolled out in two years’ time,” said Felix Schoeller, general manager of AAL Shipping.

With most of its focus on steel trade between from Asia to the EU, U.S., Middle East and Australia, and vice versa, AAL is currently not a major player in the trans-Atlantic steel shipping business.

“That said, open trade will benefit the entire shipping industry and we are always pro fewer trade barriers,” Schoeller said.

“Today, steel prices in the EU are under pressure due to the chip shortage and energy crunch, while prices in the U.S. remain elevated, and this opens opportunities for arbitrage play in 2022.”

One expected beneficiary of the EU-U.S. trade deal is the port of Rotterdam. Europe’s largest port saw throughput of “other breakbulk” increase by 14.7 percent year-on-year in the first half of 2021 “mainly because of the rise in non-ferrous metals and steel.” Following the U.S.-EU metals truce, Business Manager Twan Romeijn told Breakbulk he was “cautiously optimistic” on EU exports of steel in 2022 via the port’s stevedores.

Although the quota size was based on historical exports, Romeijn said the 3.3 million tons duty free limit was a lower level of export sales to the U.S. than achieved by EU steelmakers immediately before the Section 232 tariffs were introduced.

“Nonetheless,” he added, “any agreement is better than no agreement, and the cooperation between the U.S. and EU to invest in carbon free steel production is good news.

“And we expect EU steel demand to continue to grow modestly in 2022, which indicates that steel imports will also increase further next year.”

New Customers

Rotterdam caters for steel at a number of facilities located across the port, including those operated by Rhenus Logistics, Steinweg Group, Broekman Logistics, Metaaltransport, JC Meijers, Matrans Group and RHB. Romeijn said each terminal operator had its own customers, but it was their collective ability to attract new clients and plug into fresh trade flows that explained the port’s overall rising volumes of steel products moved as breakbulk in 2021.

“Volumes of steel are up due to the fact that multiple stevedoring companies won tenders for steel distribution,” he explained. “Next to that, a lot of ‘spot-traded’ steel is finding its way into Rotterdam. Steel enters the port in multiple varieties such as plates, coils, tubes, wire and rebars.

“Volumes of steel are up due to the fact that multiple stevedoring companies won tenders for steel distribution,” he explained. “Next to that, a lot of ‘spot-traded’ steel is finding its way into Rotterdam. Steel enters the port in multiple varieties such as plates, coils, tubes, wire and rebars.

“[Also], we see a lot of steel being handled as breakbulk as compared to steel being transported by container. This is due to the fact that container prices have increased and therefore shipping as breakbulk has become more favorable.”

Rotterdam’s optimism on steel is supported by a largely positive global outlook for steel demand, albeit risk levels to those forecasts are high, not least due to rising Covid lockdowns in regions such as Europe that could dampen demand, and ongoing doubt over the future direction of a number of Chinese policies.

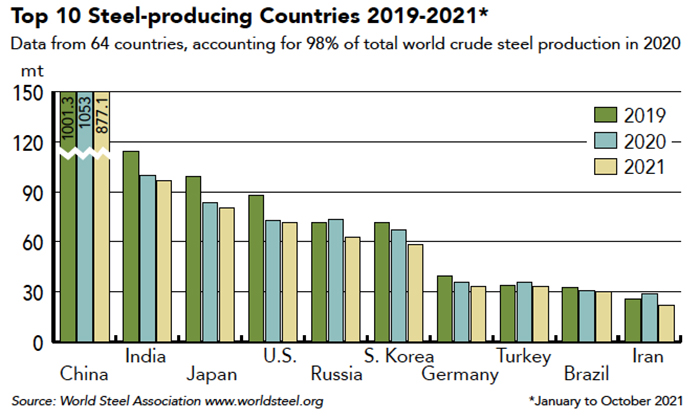

China produced 877.1 million tons of steel from January through October 2021, according to data from the World Steel Association, or worldsteel. The next largest producer over the period was India which produced 96.9 million tons. India was followed by Japan, the U.S. and Russia, which churned out 80.4 million, 71.7 million and 62.5 million tons, respectively.

Worldsteel estimates that steel demand will grow by 4.5 percent in 2021 and reach 1.86 billion tons after recording just 0.1 percent growth in 2020 as the pandemic hit global economic activity. In 2022, steel demand will see a further increase of 2.2 percent to 1.9 billion tons.

Worldsteel’s current forecast assumes that, with the progress of vaccinations across the world, the spread of variants of the Covid virus will be less damaging and disruptive than previous waves. However, as Breakbulk went to press, analysts and economists were still weighing the likely impact of more stringent EU lockdowns on economic growth and steel demand.

The China Question

Moreover, in China, discerning what current carbon emission policies mean for steelmakers is difficult. Certainly, efforts to reduce emissions from coal burn saw steel output slow to just 71.6 million tons in September, down 23.3 percent compared with a year earlier.

Al Remeithi, chairman of the worldsteel Economics Committee, said 2021 had seen a stronger-than-expected recovery in steel demand, leading to upward revisions in forecasts across the board except for China. “Due to this vigorous recovery, global steel demand outside China is expected to return earlier than expected to its pre-pandemic level this year,” he said.

The Chinese economy sustained its strong recovery momentum from 2020 into the early part of 2021 but has slowed since June.

According to commodity researcher Fastmarkets, China’s exports of steel products fell by 423,000 tonnes (8.6 percent) in October when compared with September to reach just 4.5 million tons. This was the fourth month of month-on-month declines, according to data from the country’s General Administration of Customs. However, exports were still 11.3 percent higher in October this year when compared with October 2020.

China removed value-added tax rebates for hot-rolled coil exports and for cold-rolled coil and hot-dipped galvanized coil exports on May 1 and August 1, respectively. Yet there have been suggestions that if slowing demand for steel from within China stabilizes prices this could also see export duties introduced if exports surge. “A sharp rebound in export volumes will draw attention from the central authorities,” one Shanghai-based trader told Fastmarkets in November.

Carrier Thoughts

From a carrier’s perspective, steel remains a vital element of the breakbulk mix, particularly given that most analysts expect container freight rates to remain at historically buoyant levels at least through 2022.

“Steel has always been an important base cargo for AAL, especially on our regular and liner routes, where the commodity is an integral part of our cargo mix and customer demands,” AAL’s Schoeller said. “This very much applies to our liner services between Europe and the Middle East and Asia.”

The end customer base for steel delivered by AAL is diverse. Schoeller noted that in 2019, about 52 percent of global steel usage was for building and infrastructure, 16 percent was for mechanical equipment and 12 percent was for automotive, with the three sectors combined accounting for 80 percent of global steel usage.

“During the past two years of the pandemic, governments around the globe injected trillions into infrastructure projects for the sole purpose of driving economic growth,” he said. “Therefore, these projects will be the key driver in the medium term.

“Furthermore, the world population is expected to increase from 7.8 billion in 2020 to more than 8.5 billion by 2030. This too will drive demand for housing globally.”

He said worldsteel projections of 2.2 percent growth in steel demand were also a positive. “This projection has factored in the slowdown of the China property sector, which may result in zero growth in steel demand for 2022,” he added. “Nonetheless, the current energy crisis, chip shortage and the slowdown in China’s residential housing are combining to have a significant impact on demand and steel prices across all grades.”

Michael King is a multi-award winning journalist as well as a shipping and logistics consultant.

Photos 1: AAL A-Class 31,000-dwt ‘mega-size’ vessel with steel in Rotterdam. CREDIT: AAL SHIPPING (AAL)

Chart: Top 10 steel-producing Countries

Photo 2: Felix Schoeller, AAL Shipping

Photo 3: Steel remains a vital element of the breakbulk mix. CREDIT: FVA