Apr 02 | 2021

Bloomberg Scores Carbon, Climate Transitions

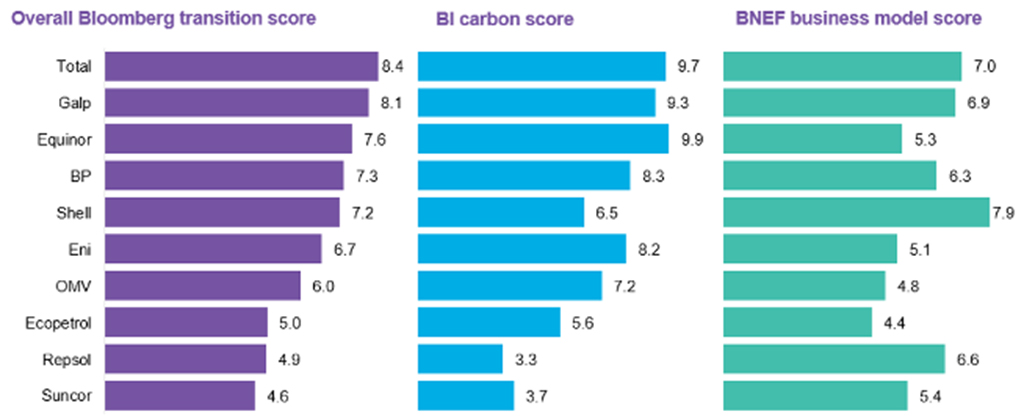

European oil companies, including Total, Galp, Equinor, BP and Royal Dutch Shell, are leading the global industry’s efforts to prepare for a low-carbon world, according to research by new research by Bloomberg Intelligence.

The five European leaders are among 39 publicly trade oil and gas companies graded by Bloomberg’s Climate Transition Scores, which “illustrate the challenges oil and gas companies face in positioning themselves for a net-zero world,” the research firm said in a statement.

The five European O&Gs ranked highly by setting ambitious climate targets and committing to deep transition related investments to turn the tide of widespread carbon action. As an example the five majors own about 11 gigawatts, or 78 percent of the renewable energy assets held by the 39 companies scored.

“The transition to a low-carbon economy in the oil and gas sector is a complex undertaking, requiring considerable change and a shift away from fossil fuels-based business models,” said Patricia Torres, global head of sustainable finance solutions at Bloomberg. “The Bloomberg Climate Transition scores, combined with Bloomberg's research, provide insight into how prepared companies are for a net-zero world and are a supplement to Bloomberg's broader environmental and social scores.”

Making Their Marks

The Climate Transition Scores are proprietary of Bloomberg’s two research teams:

• Carbon Transition Scores, from Bloomberg Intelligence, or BI, weigh where a company is today, and where it’s planning to be with respect to carbon performance.

The score includes assessing current and future emissions, which show each company’s carbon intensity, recent reduction, future carbon intensity, future reduction, and comparison to the International Energy Agency’s 2 degrees Celsius benchmark.

Equinor, Total, Galp, and Eni finished first through fifth in carbon score (see chart above), BI said.

• Business Model Transition Scores from BloombergNEF, or BNEF, look at a company’s current business model and actions it’s taken to adapt to a low-carbon environment.

The business model score considers factors such as deployment of new technologies, fossil fuel expansion, current business model, climate disclosure and progressive governance, with the BNEF score based on business model risk exposure and business model adaptation as the main pillars.

Under the BNEF business model scores, Shell topped the list, due to aggressive transition activities and a resilient fossil fuel business, while most companies are still investing most of their capital expenditures into fossil fuels, BNEF said. Total, Galp, Repsol and BP were second through fifth.

“When it comes to deploying low-carbon technologies, these companies do a lot of marketing, but their disclosure is limited and patchy, making comparison impossible,” noted Jonas Rooze, head of sustainability research at BNEF. “What makes these scores unique is that the bottom-up BNEF datasets shine a light on what these companies are actually doing – or not doing – to develop new low-carbon business models.”

Meanwhile, BI’s Carbon Transition Scores show that nearly one-third of the companies scored have established net-zero targets for operational emissions, and five include Scope 3 emissions – which includes all other indirect emissions that occur in a company’s value chain – in their net-zero goals.

Of the dozen companies with net-zero targets, seven companies, including Eni, Total, Equinor and Occidental, have targets that that will align them with the International Energy Agency’s Sustainable Development Scenario by 2030. Those seven companies to surpass the 44 percent reduction in operational emissions intensity by 2030, which the IEA suggests.

Despite pressure from investors, regulatory action and shifts in demand to push O&Gs to reduce gashouse emissions, the 39 graded companies fall into “two distinct camps,” said Eric Kane, head of ESG research, Americas at BI. One-third have set targets to cut Scope 1 (fuel combustion, company vehicles and fugitive emissions) and 2 emissions (purchased electricity, head and steam) emissions. “More than half don’t even report their Scope 3 greenhouse gas emissions – 85 percent of the total footprint for the average company.”

For the second camp, “transition strategies are increasingly ambitious, with leaders aiming for net zero,” Kane said. BI’s Carbon Transition Scores “make carbon reduction strategies comparable, translating them into carbon forecasts, and then allowing users to assess further carbon intensity against a temperature-aligned benchmark,” he added.

BI and BNEF plan to continue to publish respective transition scores for other high transition-risk sectors, such as metal and mining and automakers. BI has already published carbon transition cores for more than 50 major utilities, with BNEF soon to follow.